Desertman84

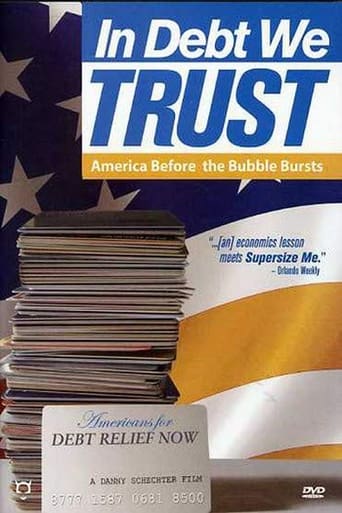

Danny Schechter investigates mounting debt crisis that Americans are facing in this documentary entitled,In Debt We Trust.It informs the viewer on how many Americans are becoming dependent on credit cards and how this could affect them in the years to come with frightening consequences. The documentary reveals how credit card companies,lobbyists,the media and President George W.Bush's administration have conspired to the deregulation of the lenders to maximize the dependency of Americans on credit cards and to firmly establish the culture of credit in to the American lifestyle. It also informs the viewer the how financial and political complexities brought about to Americans to become in debt so that they find themselves being involved in maxing out credit cards,bankruptcies and house repossessions.Interviews were made to educate viewers of how politicians and lenders made this happen.Added to that,we also get to know how young people get burdened with so much debt with respect to student loans before to get into their first job. As all of these are discussed,we get to see how this will eventually affect the society and country in terms of economic stability and eventually the global economy considering that the world is dependent primarily on the United States' economy.What makes this documentary good is the fact that it provides information not only on what currently happening when in the lending industry and the government but it also provides information to the public on how to empower themselves to avoid the traps of debt dependency.While some may find this basic information that the consumer should already know,people with limited knowledge on credit will find this highly informative on decisions they should make in the future when it comes to money and credit and definitely entertaining as they makers of the documentary made it easy to understand.

david-sarkies

I have watched this before, but when I watched it last night this film basically scared the hell out of me. It is not because I am in debt, or am tempted to get into debt, but rather how the modern financial institution is creating a new feudal class system where the lower class is enslaved through debt. Now this is not necessarily the case here in Australia where we have a minimum wage, and free healthcare (to an extent, but at least it is affordable, when you have health insurance that is) so some of the reasons why people get into debt into the United States simply does not occur here (though with our current government we could quite easily begin heading in that direction).However, I have been toying with the idea of taking out a mortgage to purchase a home (though I have a substantial amount of savings, as well as a pretty decent deposit) and after watching this film it made me wonder whether I should go ahead with this. I should remember though that what is being talked about here is consumer debt, not mortgages (which are tied to a physical asset which generally gains in value). Okay, I may never actually own the full title to my home, but in a way it is something that I will probably not aim to do simply because there may come a time when I wish to liquidate it (and some people do that and move to a country where they can live like kings).I think the problem is, and this is outlined in the film, that the economy is supposed though consumer activity, and when the consumers run out of money they can no longer purchase stuff, and as such they need to be given money (through debt) so that the economy doesn't collapse. This has a knock on effect of enslaving these people because in many cases they do not have the ability to pay it back. Financial institutions spend millions of dollars selling debt and creating the impression that we can have the good lifestyle now through the use of credit. However I basically eschew consumer debt because it is a debt based on nothing (though have in the past almost fell into that trap, and it was only through God's intervention that I did not get my hands on that credit card).The other interesting thing that is raise is that the idea that governments and corporations get into debt with the intention of never paying it back. We are not talking about small businesses (who have a line of credit) but mega corporations that effectively function like governments. These companies continue to raise debt and that debt is issued in the form of bonds, and even though those bonds have an expiry date, the corporations end up rolling them over into new bonds. They never intend on paying that the full value of those bond (ie redeeming them) but end up keeping them in perpetuity, until such a time as the company can no longer pay the interest and goes bankrupt.It is a shame that we can't operate like a company, but then again companies, while being an entity, are a different beast than humans, and can exist as long as they are able to pay the interest on that debt. Once the company can no longer pay the interest, the company effectively dies.

nederhoed

This documentary shows the influence of debt in everyday life. From consumer dependence, credit card advertisement, the economic system to politics and law.This documentary was definitely worth watching. It informs about the forms of debt you get offered by corporations, showing all consequences of the deal. It sheds light on the dark side of consumer debt.What surprised me is that no other reviewer mentions that this documentary predates the 2008 economic collapse. It tells about sub-prime loans, reselling of mortgages by banks and the uneven battle between individual consumers and big corporations.

pilothouseman

You could say that people who get enslaved in credit card debt have no financial sense and its their own fault. This film, however, shows clearly and informatively how big business and government cooperate to encourage senseless financial behavior, to the profit of the rich and loss of everyone else. It articulates well the observation of mine and many others that our society is quickly heading toward feudalism. I thought this film was much better than another current production, "Maxed Out", because it presents a comprehensive and complete picture of the situation doesn't attempt to be a drama. Everyone who spends money in the US should watch this.

AD

AD